I've been mystified by the massive swings upward in the stock market whenever Trump makes a sttement backing off his tough tariff talk. After ten years of listening to Trump throw out stalling lines whenever he feels cornered, no human investor would believe him. So why would the markets take...

continue

Fire & Flood

Buy from Amazon

Deep Past

Buy from Amazon

more info

endangered animals

rapid climate change

global deforestation

fragging

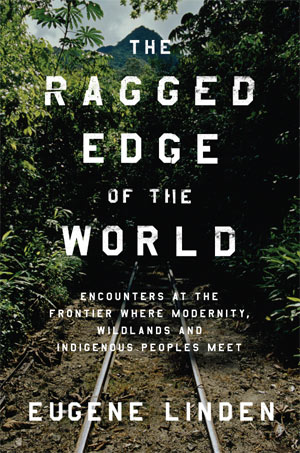

The Ragged Edge of the World

Winds of Change

Buy from Amazon

more info

Afterword to the softbound edition.

The Octopus and the Orangutan

more info

The Future In Plain Sight

more info

The Parrot's Lament

more info

Silent Partners

more info

Affluence and Discontent

more info

The Alms Race

more info

Apes, Men, & Language

more info